The big beauty business chat at the moment is who will buy Cult Beauty? It’s been quietly open to offers for a very long time but it looks like offers are on the table again. The most likely seems to be ASOS but others in the frame are reported to be The Hut Group and Zalando. At the same time, Feel Unique is up for sale. It’s currently owned by Palamon Capital Partners who bought a majority stake in 2012. Feel Unique was founded in 2005, Cult in 2007. ASOS is also thought to be interested in Feel Unique but is unlikely to buy both – the same applies to Hut and Zalando although if Hut bought both I would not be at all surprised.

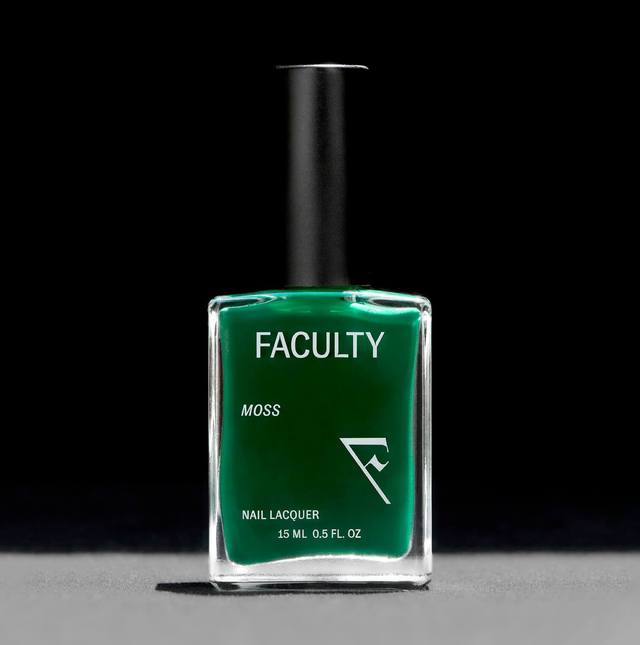

While Estee Lauder has been in the news for canning Becca and Rodin, they’ve increased their investment in Deciem. Currently, ELC now owns 76%, planning to take ownership of the final shares in 2024. They’re also main investors in a seed funding round for Faculty, a modern grooming brand, whose website currently sells green, black and grey nail polish and nail stickers in a bid to redefine masculinity. I thought we’d already established that anyone can wear whatever they want but ok. 2020’s plans to cut 2000 jobs seems to be continuing apace. The biggest question on UK beauty world’s lips is ‘who is left at Lauder?’.

Remember the shocker a couple of years ago when AMA labs were discovered to be falsifying their cosmetic testing results? If not, a quick reminder. AMA was responsible for testing the safety and efficacy of cosmetics and sunscreens. From 1987 to 2017, AMA falsified their testing numbers using fewer panelists than required and stated, consequently sending brands fraudulent safety reports. Obviously, this led to misbranding and claims that were incorrect – horrifying when it comes to sunscreen. Sunscreen efficacy is tested on humans, according to Lab Muffin, by using 2 milligrams of product per square centimetre of skin and exposing it to a special UV lamp. Formulas are then adjusted according to the results and product can go through many testing rounds. The case came to court in May, with the founder, Gabriel Letizia, pleading guilty of conspiracy to commit wire fraud and two counts of causing a misbranded drug. The first carries a maximum penalty of five years, the second one year.

Unsurprisingly, Coty is having a look at increasing profitability by streamlining their product portfolio. I think this is something we will see a lot of in coming months across the board as brands get ruthless about their amount of stock as well as new product launches. Individual products will have to earn their keep and not be hand held by more successful products. Certain products – let’s give toners as an example – are cheap to produce but bulk up a portfolio – might have to be culled as all products within a collection will need justification for being there on tighter ships.

When I read about P&G’s new skin care range for sensitive skin, GoodSkin MD, I knew it rang a bell. Boots has a brand called Your Good Skin launched in 2017. At the time of the Boots launch (their first ‘own brand’ skin care for 15 years) Your Good Skin was supposed to be a reignition of Boots as a beauty authority and yet since launch, I don’t think I’ve heard of it since. It still exists with 13 products instead of the starting point of 15. P&G’s GoodSkin MD looks interesting – it has already soft launched HERE and it definitely has a little bit of Drunk Elephant about the packaging.

Unilever is in the process of purchasing Paula’s Choice, the a more affordable skin care line founded by ‘cosmetics cop’ Paula Begoun. I love this choice – recent Unilever acquisitions have tended towards mid and luxury skin care (Tatcha, Hourglass, Murad, Kate Somerville) but Paula’s Choice has a similar price point to REN. The sale is expected to complete later this year.

Parts of Debenhams have been bought by Boohoo aiming to relaunch it as an on-line destination by autumn. Boohoo has picked up all the in-house brands and you can expect to see up to 200 beauty brands on a revved up platform.

Beiersdorf (Nivea) has soft launched a range of personalised skin care under the name O.W.N. standing for Only What’s Needed. It’s clever. With basics of cleansers and day and night moisturisers, it uses AI and algorithms to select the right formula additions for your skin (out of 380,000 combinations). When filling out the on-line questionnaire you can choose your fragrances (lime, lavender etc) but are never told what added ingredients to target your concerns it contains before you purchase. It’s only in a couple of selected markets currently so clearly not ready for a roll out – we love an INCI. It’s a nice touch that you can add your name to the pots.

Beiersdorf

The new brand is being launched in key European markets with a simple routine: facial cleansing plus day care as well as evening facial cleansing plus night care. O.W.N uses artificial intelligence and is built around a proprietary algorithm that brings together Beiersdorf’s profound 140 years’ skin care expertise and consumer knowledge. Thus, it is able to select the single best unique product offering out of 380,000 formula combinations. Fully in line with the strategic focus of advancing digital transformation within the C.A.R.E.+ strategy, the products are sold as part of a purely digital business model via the website www.ownskincare.eu. Here, consumers are given the opportunity

Brand to watch: Fig.1:

Sources: Beautyindependent.com, globalcosmeticsnews,

Transparency Disclosure

All products are sent to me as samples from brands and agencies unless otherwise stated. Affiliate links may be used. Posts are not affiliate driven.

11 comments

I love your beauty business news, nobody else I follow does this. It’s so interesting and informative about what’s going on behind all the smoke and mirrors.

Thank you for always keeping it real. Xx

Ps I’ve followed you for a long time and I’ve only recently worked out how to leave comments, massive technophobe on tinternet

Well done Jenny – I speak as someone battling with an on-line diary… technology is a pain sometimes! Thank you for leaving such a lovely comment – it’s really appreciated.

Your Good Skin feels like such an after thought when you go to Boots, and I don’t understand the packaging during this wave of minimalist trend (that has lasted for a while now).

That being said, I did buy their SPF 30 day cream as it was on sale and now it’s my staple day cream. I would be heartbroken if they discontinue it. Also the eye cream turns out to be good and I have to say I love the price, not to mention it is constantly on sale (not a very good sign).

Good to have an endorsement for it – I never even think of it so it’s good to know that some of their products have made an impact.

I agree, I always find these articles interesting. I like to know what companies are behind the brands I buy

It’s my feeble little hope that beauty companies stop gobbling up so many smaller companies. They never treat the new companies with as much respect and dedication as they had when they were independent (or more independent, I should say – I know a whole portfolio of brands isn’t exactly new). I know these brands exist to make money but the business cogs who run the big brands just flatten and cheapen as they jack up the prices and it makes me sad at what we’ve lost.

I was having exactly this conversation with a friend yesterday – all the new start ups are only there to be bought further down the line. A lot are incubated by bigger brands who provide the funding in the first place so it’s basically sowing all the seeds to pick the best plants themselves.

I love and read your articles related to the news in the beauty industry! I hope Paula’s Choice’s line, after the acquisition, comes to European stores as well.

I hope so too!

I recently started using Your Good Skin Balancing Skin Concentrate – it’s a keeper but I totally get the packaging gripe above. Love reading your Beauty Business News.

Oh that’s interesting… I don’t ever hear from Boots so maybe it’s not a surprise that it’s slipped under my radar – I just don’t ever hear it spoken about so grateful for your comment!